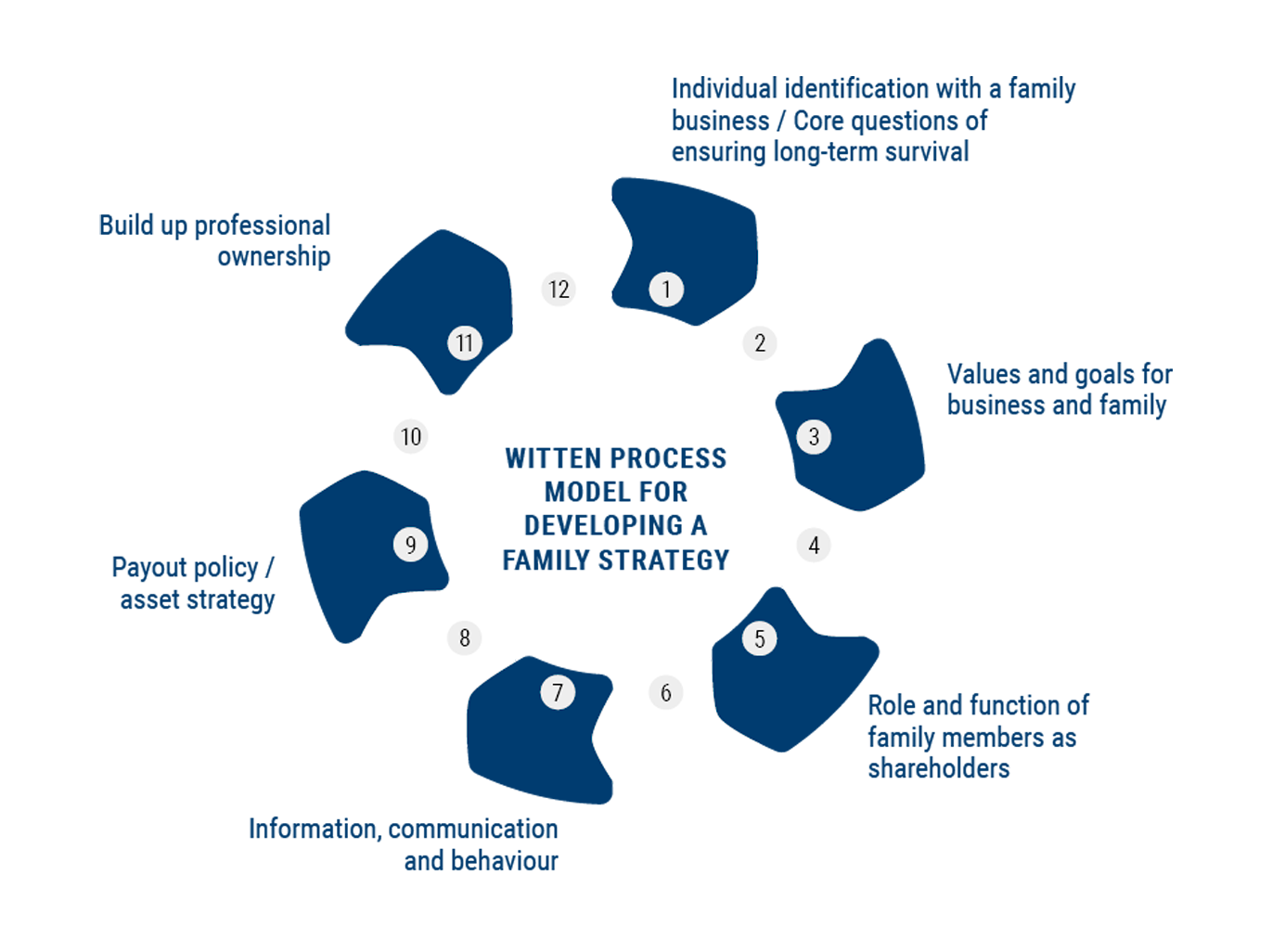

The aim is to develop a (self-) management system for the business family to help it to avoid internal conflicts and resolve them efficiently, to establish decision-making processes, to develop successors who can take on responsibility, to build up the expertise needed within the shareholder group, and much more. This kind of family management ensures that the family remains capable of acting and that they discuss critical themes with each other. Furthermore, it creates a common point of reference and a shared way of understanding values in the family business. Family management helps to implement structures that counter imbalances within the family.